Since a foreign crisis will affect a local economy through international trade, influences from the US crisis will be insignificant if the US share in Thailand’s export value is small.

In 2007, the US share in Thailand’s export value was just 12.6%, having decreased from 22.3% in 1997, not to mention the shares of another two big export markets, Japan and EU, that had also slightly decreased. Consequently, US-EU-JP share in Thailand’s export value decreased from 54.4% in 1997 to just 38.4% in 2007.

But by sharp contrast, Thailand’s export to new markets has grown rapidly. For example, Thailand’s export value to China increased 8 times during the past 10 years, with China’s share in Thailand’s export value having increased from 3.2% in 1997 to 9.7% in 2007. Export growth rates are also high for Australia, the Arab region, South Korea and India.

The shift in Thailand’s export structure, from dependency on “Big Brothers” to penetrating new and rising economies, may assuage the impact from crises in big countries, especially from the USA, as Thailand can export to other countries despite a US crisis.

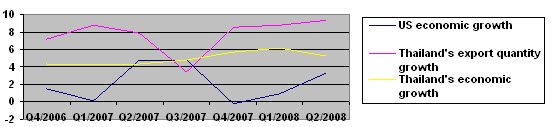

According to the illustration below, Thailand’s economic growth has been quite stable, lying in the range between 4% - 6%, in spite of US economic fluctuation. Even during the Q4 of 2007, in which US economic growth was negative, Thailand’s export quantity growth was as amazingly high as 8.5%.

Illustration 1: Economic and export growth in Thailand and USA (yoy)

Source: US department of commerce, NESDB

It is possible that the Economic Decoupling theory is true in Thailand’s case. Fluctuation in the US has not affected Thailand economic and export growth rate significantly. However, US crises, such as Subprime or Lehman’s bankruptcy may have their impact at micro level in some companies or sectors.

Thus, government policy to cope with the impact should be staged at micro level rather than macro level to provide crisis-affected companies with liquidity and to build the private sector’s confidence, in order to reassure the private sector.

Dr Kriengsak Chareonwongsak

Senior Fellow, Harvard Kennedy School , Harvard University

kriengsak@kriengsak.com, kriengsak.com, drdancando.com

Senior Fellow, Harvard Kennedy School , Harvard University

kriengsak@kriengsak.com, kriengsak.com, drdancando.com

No comments:

Post a Comment